Table Of Content

More detail is available in our Quality assurance of administrative data used in the PIPR methodology. Inflation is the rate at which prices (for renting or purchasing property) rise and fall over time. For Great Britain in March 2024, the average private rent was highest for detached properties (£1,446) and lowest for flats and maisonettes (£1,211). Average private rent was highest for properties with four or more bedrooms (£1,912) and lowest for properties with one bedroom (£995). In March 2024, the average private rent was highest in Kensington and Chelsea, London (£3,305), and lowest in Dumfries and Galloway, Scotland (£475). Excluding London, the local area with the highest average private rent in March 2024 was the City of Bristol, South West (£1,748).

UK House Prices April 2024 – NerdWallet UK - NerdWallet

UK House Prices April 2024 – NerdWallet UK.

Posted: Tue, 23 Apr 2024 19:16:19 GMT [source]

Reports and Plans

Redfin Home Price Index: Price Growth Stabilizes in March, With Prices Up 0.6% From a Month Earlier - Redfin News

Redfin Home Price Index: Price Growth Stabilizes in March, With Prices Up 0.6% From a Month Earlier.

Posted: Tue, 23 Apr 2024 14:18:22 GMT [source]

Actual transactions prices are used to compute an Index reflecting the market trends. 2) Fannie Mae and Freddie Mac (the Enterprises) purchase seasoned loans, providing new information about prior quarters. With the release of the 2012Q2 data a small but notable revision was made to how the HPI is calculated. The revision impacts the all transactions index (HOFHOPI) at the state and national level for the full history of the series (back to 1975Q1). The House Price Index is also used to establish conforming mortgage loan limits, which are based on the annual Q3 change in HPI.

Administrative data

In February 2024, the most expensive area to purchase a property was Monmouthshire, where the average cost was £333,000. In contrast, the cheapest area to purchase a property was Blaenau Gwent, where the average cost was £127,000. Comparing the provisional UK HPI volume estimate for December 2022 with the provisional UK HPI estimate for December 2023, the volume of transactions decreased by 44.3% in Wales and decreased by 42.3% in the UK.

1 Annual price change

For years in which decennial census data are available, the share from the relevant census is used. For intervening years, a state’s share is the weighted average of the relevant shares in the prior and subsequent censuses, where the weights are changed by ten percentage points each year. For example, California’s share of the housing stock for 1982 is calculated as 0.8 times its share in the 1980 census plus 0.2 times its share in the 1990 census. For 1983, the Pacific Division’s share is 0.7 times its 1980 share plus 0.3 times its 1990 share. The FHFA HPI covers far more transactions than the Commerce Department survey. The CQHPI covers sales of new homes and homes for sale, based on a sample of about 14,000 transactions annually, gathered through monthly surveys.

The RPI is also available at the zip code level and can be constructed to track price trends for specific characteristics (e.g., ranch-style house, colonial-style house, etc.) since preferences can change over time. The Case-Shiller index prices are measured monthly and track repeat sales of houses using a modified version of the weighted-repeat sales methodology proposed by Karl Case, Robert Shiller, and Allan Weiss. This means that, to a large extent, it can adjust for the quality of the homes sold, unlike simple averages. Although FHFA has published experimental house price indexes for some ZIP codes, those indexes are annual (i.e. quarterly index values are not provided). Researchers needing quarterly values for ZIP codes may be interested in using index values for the applicable metropolitan area. A comprehensive report is published every three months, approximately two months after the end of the previous quarter.

Geographies with low number of sales transactions should be analysed in the context of their longer-term trends rather than focusing on monthly movements. PIPR replaced the Index of Private Housing Rental Prices (IPHRP) and Private Rental Market Summary Statistics (PRMS) in March 2024. PIPR produces rent prices that are comparable over time (unlike PRMS) and publishes at increased geographic granularity than IPHRP.

In Canada, the New Housing Price Index is calculated monthly by Statistics Canada. Additionally, a resale house price index is also maintained by the Canadian Real Estate Association, based on reported sale prices submitted by real estate agents, and averaged by region. The FHFA HPI incorporates tens of millions of home sales and offers insights about house price fluctuations at the national, census division, state, metro area, county, ZIP code, and census tract levels. FHFA uses a fully transparent methodology based upon a weighted, repeat-sales statistical technique to analyze house price transaction data.

Ceredigion showed the highest annual percentage change, rising by 3.5% to £248,000 in the 12 months to February 2024. In contrast, Newport showed the lowest annual percentage change, decreasing by 7.5% to £220,000 in the 12 months to February 2024. This new release uses the Price Index of Private Rents (PIPR) to provide more insight into the UK private rental sector and includes headline UK HPI statistics.

Annual Report to Congress

The Cost of Living (Tenant Protection) Scotland Act capped in-tenancy rent price increases at 0% (and up to 3% in certain circumstances) from September 2022 until 31 March 2023. Between 1 April 2023 and 31 March 2024, this rent price-increase cap was 3% (and up to 6% in certain circumstances). From 1 April 2024, temporary changes to the rent adjudication system restricts rent increases for existing tenants who apply for rent adjudication. A non-seasonally adjusted series is one that includes seasonal or calendar effects. House Price Indices (HPIs) have been produced in the UK since around 1973, initially by mortgage providers and more recently by government bodies.

Interchangeable with "annual inflation" (or "annual growth", if positive). That is, the estimates of appreciation are based on repeated valuations of the same property over time. Therefore, each time a property "repeats" in the form of a sale or refinance, average appreciation since the prior sale/refinance period is influenced. Each month, Fannie Mae and Freddie Mac provide FHFA with information on their most recent mortgage transactions. These data are combined with the data from previous periods to establish price differentials on properties where more than one mortgage transaction has occurred. The data are merged, creating an updated historical database that is then used to estimate the HPI.

The quarterly purchase-only HPI is based on more than eight million repeat transaction pairs over 43 years. This gives a more accurate reflection of current property values than the Commerce Department index. The HPI also can be updated efficiently using data collected by Fannie Mae and Freddie Mac in the normal course of their business activity.

This method involves analyzing mortgage transaction data from Fannie Mae and Freddie Mac to track home value changes over time, focusing on properties with at least two successive sales. The index measures the price change of the same property over different periods, providing a realistic and consistent view of price movements in the housing market. For the nine census divisions, seasonally adjusted monthly price changes from December 2023 to January 2024 ranged from -0.6 percent in the South Atlantic division to +1.5 percent in the West North Central division. The 12-month changes were all positive, ranging from +3.8 percent in the West South Central division to +8.7 percent in the East North Central division. In Wales, 5 of the 22 local authority areas showed an increase in average house prices in the 12 months to February 2024.

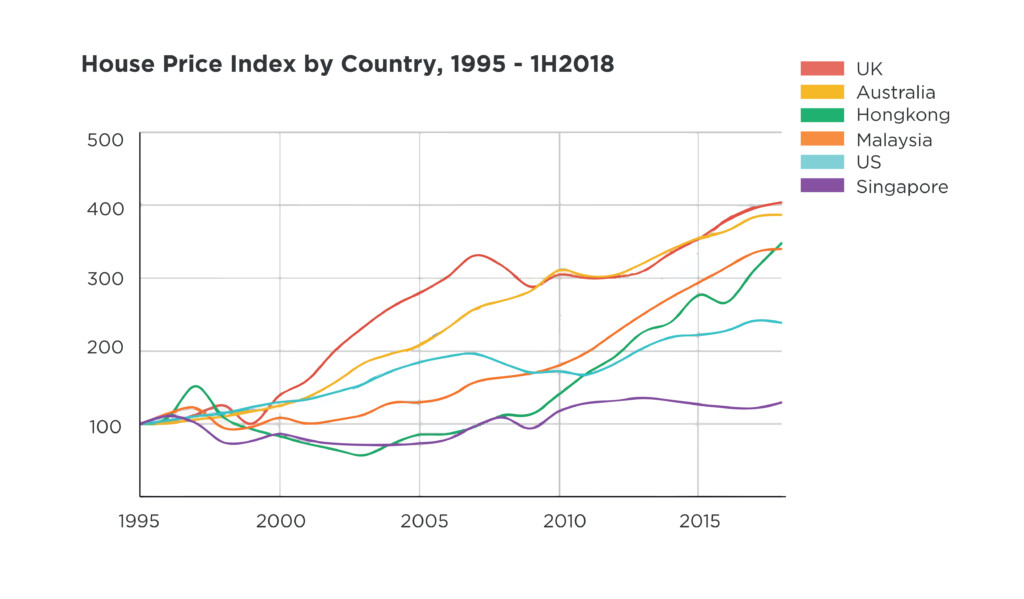

The Price Index of Private Rents (PIPR) is released as official statistics in development, and is subject to revisions if improvements in the methodology are identified. Currently, average private rent is published for Great Britain, but not for the UK. We aim to publish average rent prices for the UK and Northern Ireland in March 2025. A house price index (HPI) measures the price changes of residential housing as a percentage change from some specific start date (which has an HPI of 100). Methodologies commonly used to calculate an HPI are hedonic regression (HR), simple moving average (SMA), and repeat-sales regression (RSR). The weights used in constructing the indexes are estimates for the shares of one-unit detached properties in each state.

View any revisions to previously published data in the data downloads or find out more about revisions in our guidance About the UK HPI. The March 2024 UK HPI will be published at 9.30am on Wednesday 22 May 2024. For months, Ukrainian military officials have complained that political paralysis in the U.S. Congress had created critical munitions shortages in the war against Russia. Ukrainian troops on the front lines have had to ration shells, and morale has suffered. A sizable amount is set aside to replenish U.S. defense stockpiles, and billions more would be used to purchase U.S. defense systems, which Ukrainian officials say are badly needed.

No comments:

Post a Comment