Table Of Content

This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers. Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes. Over the course of the loan term, the portion that you pay towards principal and interest will vary according to an amortization schedule. A mortgage is often a necessary part of buying a home, but it can be difficult to understand what you can actually afford. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price, down payment, interest rate and other monthly homeowner expenses.

What You Can Learn from a Mortgage Calculator - RE/MAX News

What You Can Learn from a Mortgage Calculator.

Posted: Sun, 18 Feb 2024 08:00:00 GMT [source]

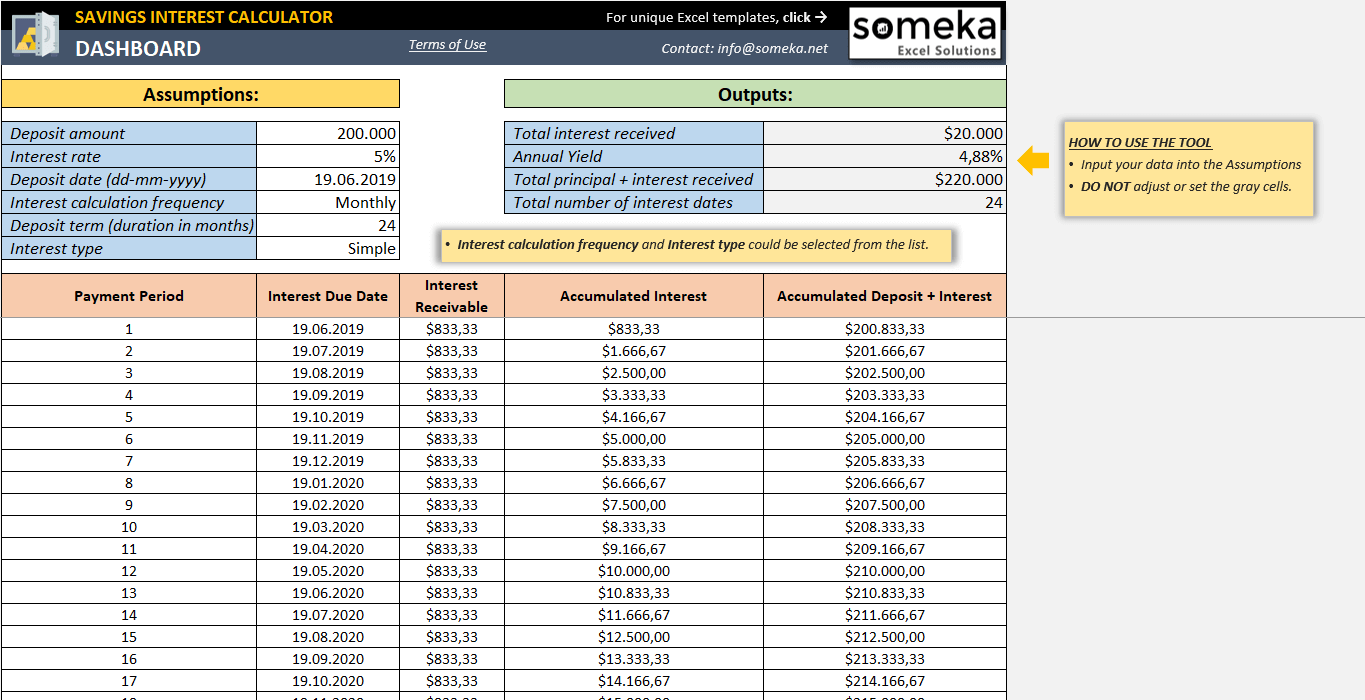

Simple interest formula (principal + interest)

It’s factored into your monthly payment and paid off throughout the life of your loan. Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living. Understanding mortgage interest is important because it affects the entire cost of your home loan. You may save money and make better financial decisions if you know how interest is calculated and how to reduce it. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate.

Sample loan programs

However, with a 15-year fixed, you’ll have a higher payment, but will pay less interest and build equity and pay off the loan faster. The longer the term of your loan — say 30 years instead of 15 — the lower your monthly payment but the more interest you’ll pay. The interest rate on a loan is calculated based on factors such as loan amount, term, and creditworthiness and can be determined using a loan calculator or formula. Use the simple or compound interest formula to calculate the annual percentage rate (APY) on a fixed interest rate.

What Are the Types of Mortgages?

By 2001, the homeownership rate had reached a record level of 68.1%. Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month. The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Frequently asked questions about mortgages

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Most recurring costs persist throughout and beyond the life of a mortgage. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox.

Use Rocket Mortgage® to see your maximum home price and get an online approval decision. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. These calculators are free and available online, allowing you to experiment with different scenarios and variables whenever you please. The table below breaks down an example of amortization on a $200,000 mortgage. You can figure out your daily periodic interest rate by taking your Annual Percentage Rate (APR) and dividing it by the number of days in a year.

Homeowners insurance rates vary depending on where you live and the age and condition of the home. For instance, you may pay a higher premium for a home that’s older or hasn’t been properly maintained. When using a mortgage loan calculator, you’ll need to enter your zip code to receive an accurate estimate. You can also adjust the interest rates to see your payments based on market conditions or your credit score. You can expect to pay the lowest interest rate available if you have excellent credit. If you don’t have stellar credit, you can still qualify for a mortgage, but it might not be at the lowest rate.

One of the rules you may hear as a homebuyer is the 28/36 rule or the debt-to-income (DTI) rule. This rule says that your mortgage payment shouldn’t go over 28% of your monthly pre-tax income and 36% of your total debt. This ratio helps your lender understand your financial capacity to pay your mortgage each month. The higher the ratio, the less likely it is that you can afford the mortgage. The interest rate is the percentage of a loan charged as interest to the borrower or the rewards received by the saver.

Depending on the economic climate, your rate can increase or decrease. For the mortgage rate box, you can see what you’d qualify for with our mortgage rates comparison tool. Or, you can use the interest rate a potential lender gave you when you went through the pre-approval process or spoke with a mortgage broker. Interest is the fee you pay to your mortgage company to borrow the money. The interest you pay is based on a percentage of the remaining loan amount. Mortgage lenders are required to assess your ability to repay the amount you want to borrow.

Here are some other useful variations of the simple interest formula, which allows you to calculate principal, rate of interest and timeframe. These simple interest calculations assume that interest is not compounded. Savings accounts earn compound interest, meaning thatinterest is calculated on the already accumulated interest over time. So, if you're looking to work out compound interest,you should use our compound interest calculator instead.

On desktop, under "Interest rate" (to the right), enter the rate. Under "Loan term," click the plus and minus signs to adjust the length of the mortgage in years. We believe everyone should be able to make financial decisions with confidence. You can apply our mortgage interest calculator by providing the following parameters. These costs aren't addressed by the calculator, but they are still important to keep in mind. The fees will not apply to goods brought into the UK for personal use, the government said.

Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. If you're refinancing, this number will be the outstanding balance on your mortgage. Down payment - The down payment is money you give to the home's seller. At least 20 percent down typically lets you avoid mortgage insurance. In addition, the calculator allows you to input extra payments (under the “Amortization” tab). This can help you decide whether to prepay your mortgage and by how much.

EMI refers to the ‘Equated Monthly Installment’ which is the amount you will pay to us on a specific date each month till the loan is repaid in full. After getting an estimate of EMI using the calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans by HDFC Bank. HDFC Bank offers various repayment plans for maximizing home loan eligibility to suit diverse needs. Note that the interest rate (r) and time period (t) are in the same time units (years for the first calculation and months for the second).

Interest is the fee for borrowing the money, usually a percentage of the outstanding loan balance. The principal is the portion of the payment devoted to paying down the loan balance. Let’s learn more about how a mortgage calculator works, and the different factors it uses to determine your monthly mortgage payments. A mortgage is a secured loan that is collateralized by the home it is financing.

PMI is calculated as a percentage of your original loan amount and can range from 0.3% to 1.5% depending on your down payment and credit score. Once you reach at least 20% equity, you can request to stop paying PMI. This is based on our recommendation that your total monthly spend for your monthly payment and other debts should not exceed 36% of your monthly income. In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate.

No comments:

Post a Comment